2025: The Year We’ll Look Back at Ontario Real Estate and Say, “I Wish I Bought Then”

2025: The Year We’ll Look Back at Ontario Real Estate and Say, “I Wish I Bought Then.

The real estate market in Ontario — especially here in Grey Bruce — has been a tough year for sellers. Active listings are at decade highs, buyers picky, and homes are sitting longer or selling for less than they would have a few years ago. For sellers, 2025 may be a year they’re glad to move past. For buyers, it could become the year they regret not pulling the trigger. And when you look at the numbers, it’s very possible that 2025 ends up being remembered as the best buying window of this entire decade. Here are four reasons I think 2025 might be the year buyers look back on and wish they had acted.

1. Interest Rates Have Come Down — and This May Be the Sweet Spot

Interest rates have dropped 2.75% from their recent peak, creating a window of improved affordability. While rates may drift a bit lower, there’s no guarantee they’ll return anywhere near the ultra-low levels we experienced between 2009–2021. Those rates were historically unusual — and unlikely to come back anytime soon.

What matters today is certainty: buyers can lock in a reasonable rate now, rather than waiting on predictions that may never materialize — or worse, missing the opportunity if rates rise again while prices rebound.

2. Buyer Hesitation = Less Competition

With consumer confidence near historic lows, many buyers are sitting on the sidelines waiting for “perfect” conditions. That hesitation has pushed active listings to decade highs, giving buyers something we haven’t seen in years:

choice and negotiating power.

Unlike the pandemic frenzy — where buyers competed with 10+ offers, paid over asking, and waived conditions just to have a chance — today’s buyers can:

-

Include financing conditions

-

Include inspection conditions

-

Include conditions of sale

-

Negotiate on price, repairs, or closing costs

For move-up buyers who need to sell before buying, this is one of the best markets in years to make a transition safely and strategically.

3. SellersAre Motivated — But That Won’t Last

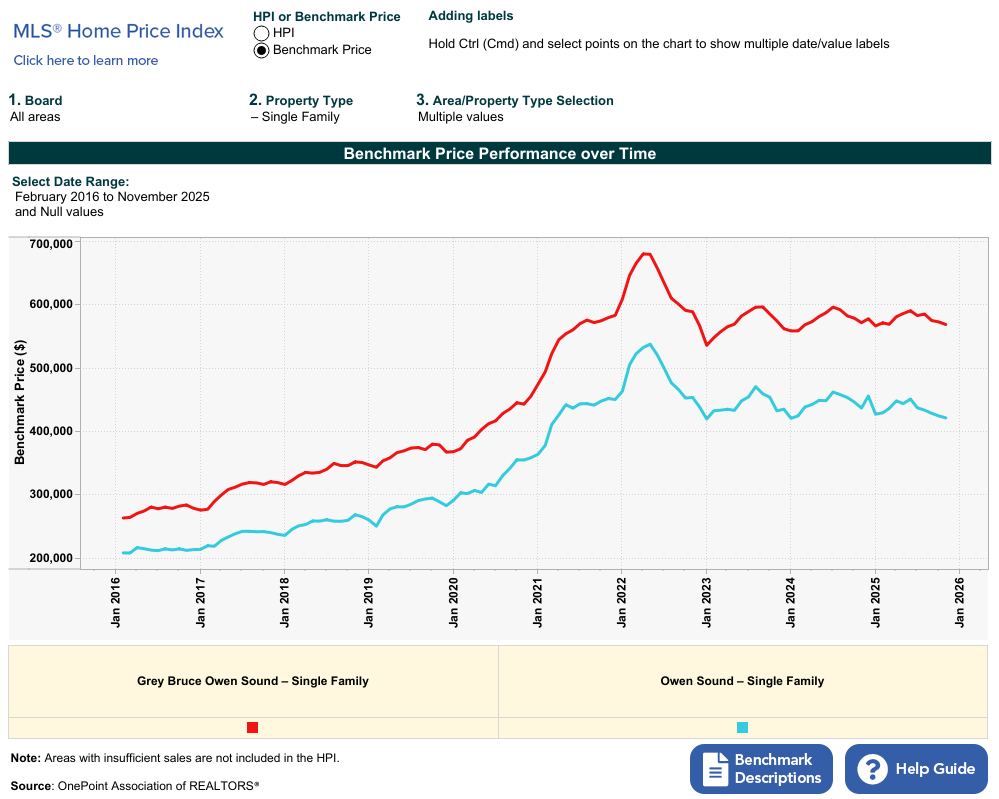

With increased inventory and longer days on market, prices have now softened for multiple months in our local area:

-

3 straight months of declines in Grey Bruce

-

6 straight months of declines in Owen Sound

From peak pricing, values are now down roughly 15–20%, with month-over-month softening continuing. We’re also seeing wider gaps between list price and sale price, rising price reductions, and more willingness from sellers to negotiate

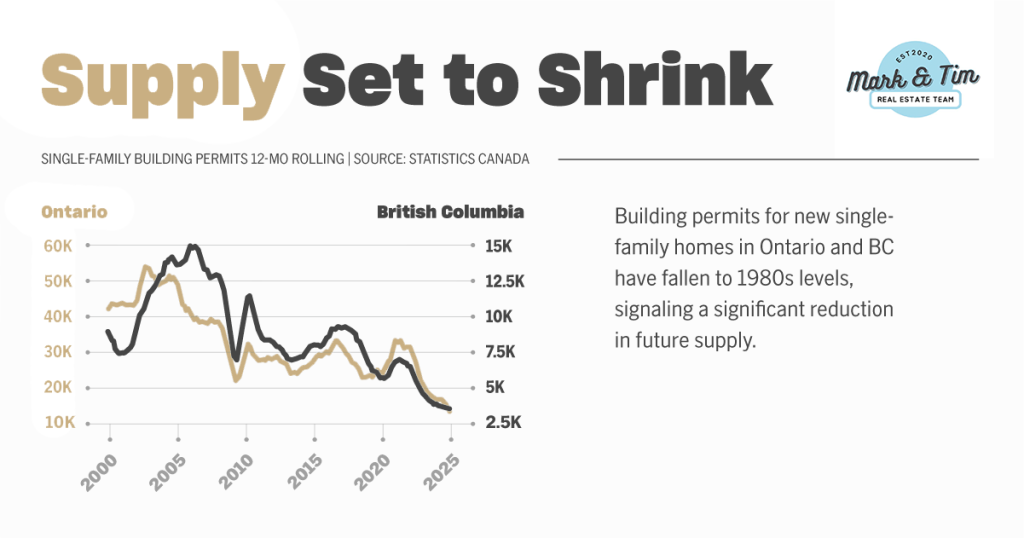

4. Supply & Demand Pressure Is Still Building

While prices have cooled short-term, the underlying supply challenge hasn’t disappeared:

Ontario and BC remain the only provinces experiencing flat or declining prices

New construction has slowed

Home sales remain under 10 year averages

.

Image source: Edge Analytics

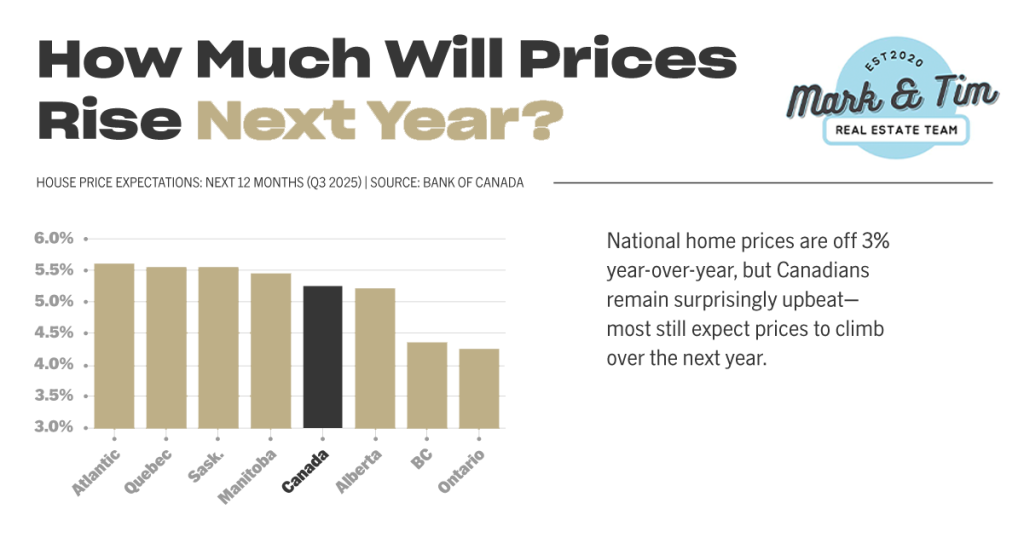

It’s hard to say where the market will go in 2026, but it does feel as if the worst is behind us for 2025, with house price expectations set to rise in 2026.

Tim Matthews is a Real Estate Broker providing real estate services to the Owen Sound and Surrounding Regions. For a full buyer or home selling consultation, reach out to time at 519-375-7153 or timmatthews.ca

Sources:

Edge Analytics, CREA, Habistat

Is the market about to take off?

The Real Estate Market is about to go off?

I recently attended a real estate conference and had the opportunity to sit in on a session with CREA economist Shaun Cathart. He made the case that the real estate market is going to improve and could do so quite quickly over the next year due to a combination of new mortgage rules, interest rates dropping and an overall shortage of quality supply. Let’s go through them:

- New mortgage rules to be implemented on December 15th are a big deal. The new rules will increase the CMHC insured amount that a borrower can get from $999,999 to $1,500,000. Previously, you could purchase a house with 5% down up to 1 million, anything over that you needed to have 20% down as you could not get CMHC insurance. The new rule is now 5% on the first $500,000 and 10 % on the rest. This rule will have minimal impact in smaller markets where average prices are well below a million, but in larger markets like Toronto and Vancoubver it will make a difference. The 2nd rule is increasing the mortgage amortization period from 25 years to 30 years. Mortgage amortization is the length of time it takes to pay off the loan. 30 year options will reduce monthly payments, but increase the overall amount of interest one would have to pay. In a recent article written by Tracy Head, The Mortgage Gal she broke down how the changes would affect things with this example: To purchase a $500,000 home with a 25-year mortgage, your family income needs to be about $112,000, with a 30-year mortgage, your income needs to be around $105,000. OR if your family earns $112,000, you can afford a $500,000 home with a 25-year mortgage. If you go for a 30-year mortgage, you could afford a $535,000 home. That extra 35k can make a big difference for buyers.

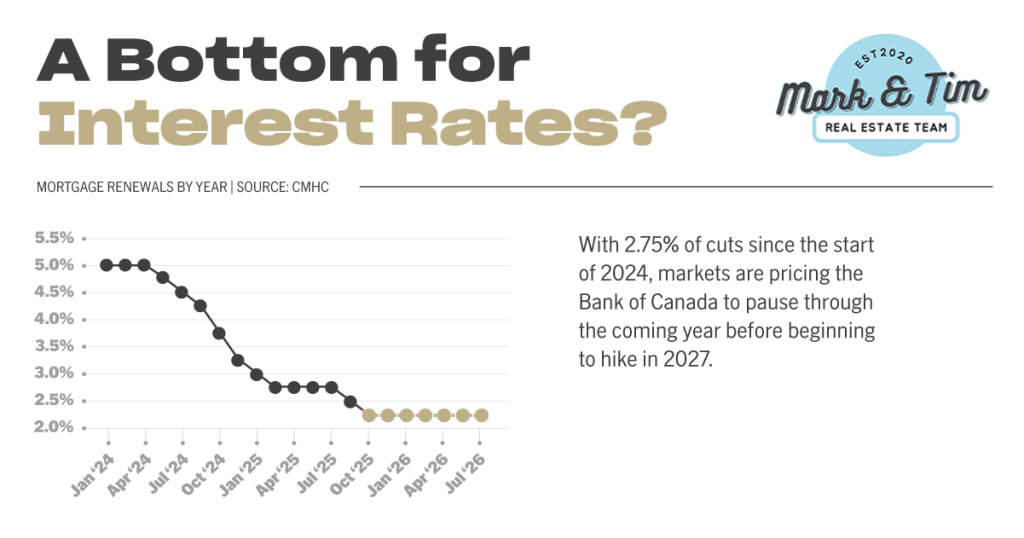

- The bank of Canada is dropping interest rates at a faster rate than we thought. Shaun shared an interesting graph. One that showed how much The Bank of Canada was expected to drop the interest rate at various times over the last year. One year ago rates were expected to drop 3.5% by 2027. As of September 23rd they are expected to drop down to 2.5% by mid 2025, that is huge news! Check out the image below.

- An overall shortage of supply can be seen in what the national month of inventory sits at which is hovering in balanced market territory but much closer to a sellers market then a buyers market. The combination of a fast reduction in rates, with these mortgage rules could result in the month of inventory tipping quickly into a sellers market.

He closed with some interesting stats that make the case we may have hit the bottom of the market. New listings spiked for the month of September, but a big change in the amount of sales has taken place in the 7 day moving average chart for September. This is strong data that does point to tightening market in the coming future. However, people should not assume prices will skyrocket again quickly as there is a reason rates are dropping quickly as people are struggling. There are more listings on the market and the overall sentiment is not great amongst buyers, but the idea that we may have seen the bottom is a good one.

My thoughts? There remains a lot of inventory for sale in the Grey Bruce & the market is challenging with 10 year highs for inventory. Watch my most recent market update below.

Sources:

The Canadian Real Estate Association

Tracy Head

Canadian Mortgage Trends

Bank of Canada pauses rate hiking cycle, what does this mean for prices in Grey Bruce?

The affect of rate hikes on the market

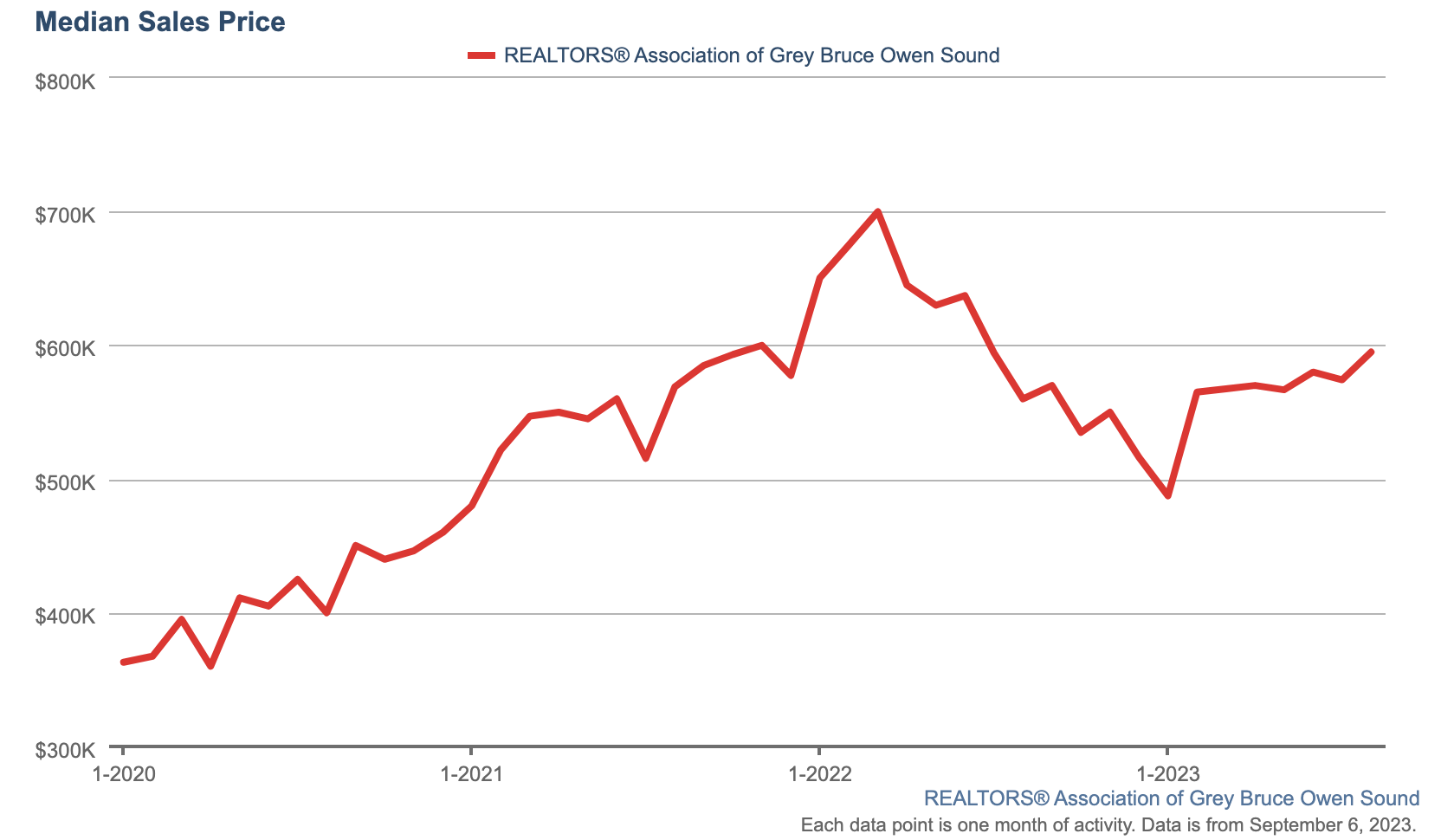

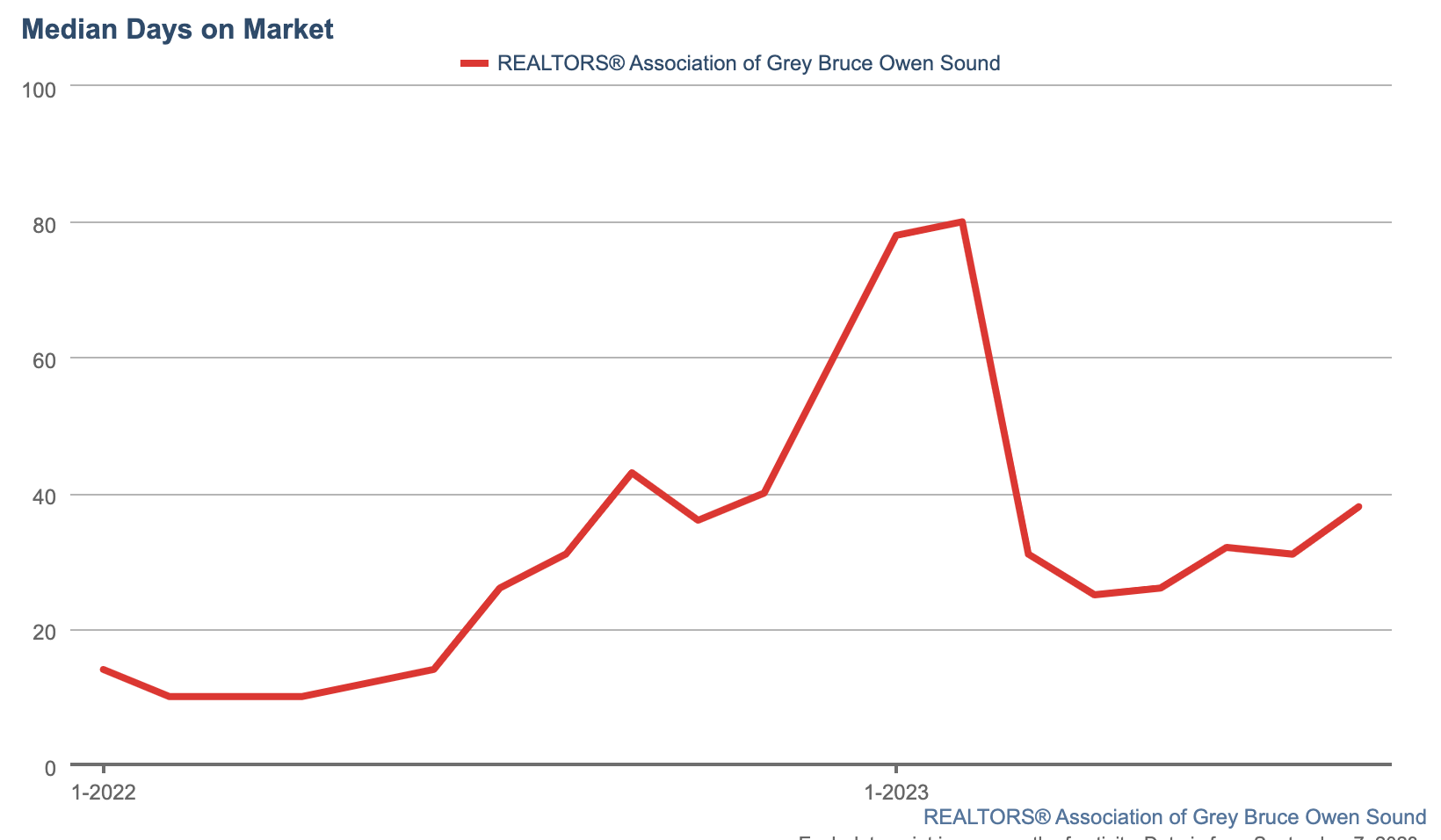

The Bank of Canada paused its hiking cycle, maintaining its overnight rate at 5% as announced at their September meeting on Wed, September 6th. The decision to pause was based on evidence that access demand in the economy is easing. Since early 2022, the BoC has increased its overnight rate ten times from 0.25% to 5%. Naturally, this has led to a decrease in home sales and prices across Canada. In Grey Bruce, prices have dropped by 15% from their peak. When the rate hikes began, the median sale price of a single-family home was $700,000. The market bottomed out in January 2023 at $487,500 but has since rebounded to $595,000. The rise in interest rates has undoubtedly cooled the market, reducing buyers’ purchasing power and forcing many buyers to the sidelines, opting to wait and see what happens next. This has resulted in the average time to sell a home increasing from 10 days to 38. The question now is whether the current pause will entice buyers back into the market?

The first pause occurred in March, leading to a substantial increase in home sales until June when rate hikes resumed. Since then, sales have been on a downward trend. The key difference between the current pause and the previous one is the noticeable increase in fixed interest rates, as indicated by the 5-year Government bond graph. In April, fixed rates were hovering around 4.5%, but now they have surpassed 5%. Both variable and fixed rates remain high at this time.

What to expect in the future?

It is reasonable to anticipate a slight upturn in the market due to the combination of the Bank of Canada’s pause and the onset of the fall market season. However, it’s important to take into account the Bank of Canada’s press release, which reiterates their close monitoring of inflation and readiness to raise again if needed. Some indicators that still suggest that inflation remains a concern, especially with the Consumer Price Index coming in higher than expected in July. Whether or not the pauses in interest rate adjustments will persist depends on how future inflation data align with the Bank of Canada’s expectations, a matter that only time will tell.

We are far from in the clear, but for now a sigh of relief.

Sources:

https://www.bankofcanada.ca/2023/09/fad-press-release-2023-09-06/

Realtors Association of Grey Bruce, ITSO

https://www.ratehub.ca/historical-mortgage-rates-widget

Thinking of selling your Owen Sound/Grey Bruce home in 2023? Here’s what to expect

Thinking of selling your Owen Sound/Grey Bruce home in 2023? Here’s what to expect: Updated Sept 7, 2023

As we enter into the fall market of 2023, what should I expect if I am thinking about putting my home up for sale in the Owen Sound and Grey Bruce Area? That’s a great question, and to answer it I’ll take a look at the statistics, and also provide some on the ground analysis from what I am seeing with my current listings and buyer clients.

How long will it take?

Let’s begin with days on market, or how long is it taking for the average home to sell? Below, you can view an interactive graph that charts the monthly statistics for the days on market in Owen Sound and Grey Bruce.

How much will it sell for?

How much money should I expect my home to sell for? Well, no one can know for certain what you will get, but the average home seems to be selling for 97-98% of its listing price. Below, you can view an interactive chart that shows the median sale prices for Owen Sound and Grey Bruce. Remember, these are just general statistics and your home value will be based on sold comparables.

Why has the market changed?

Why has the market changed ? In 2023 Canada has seen the BoC raise rates from .25% up to 5%. The speed at which this has happened has flattened the market. Along with the Variable rate changing, fixed interest rates are also remaining high for what we have been used to over the last 10 years. The high rates have reduced buyers purchasing power and put fear in buyers, causing them to want to wait and see what happens. Below you can view an interactive chart of variable and fixed interest rates.

Is it a buyers market or a sellers market?

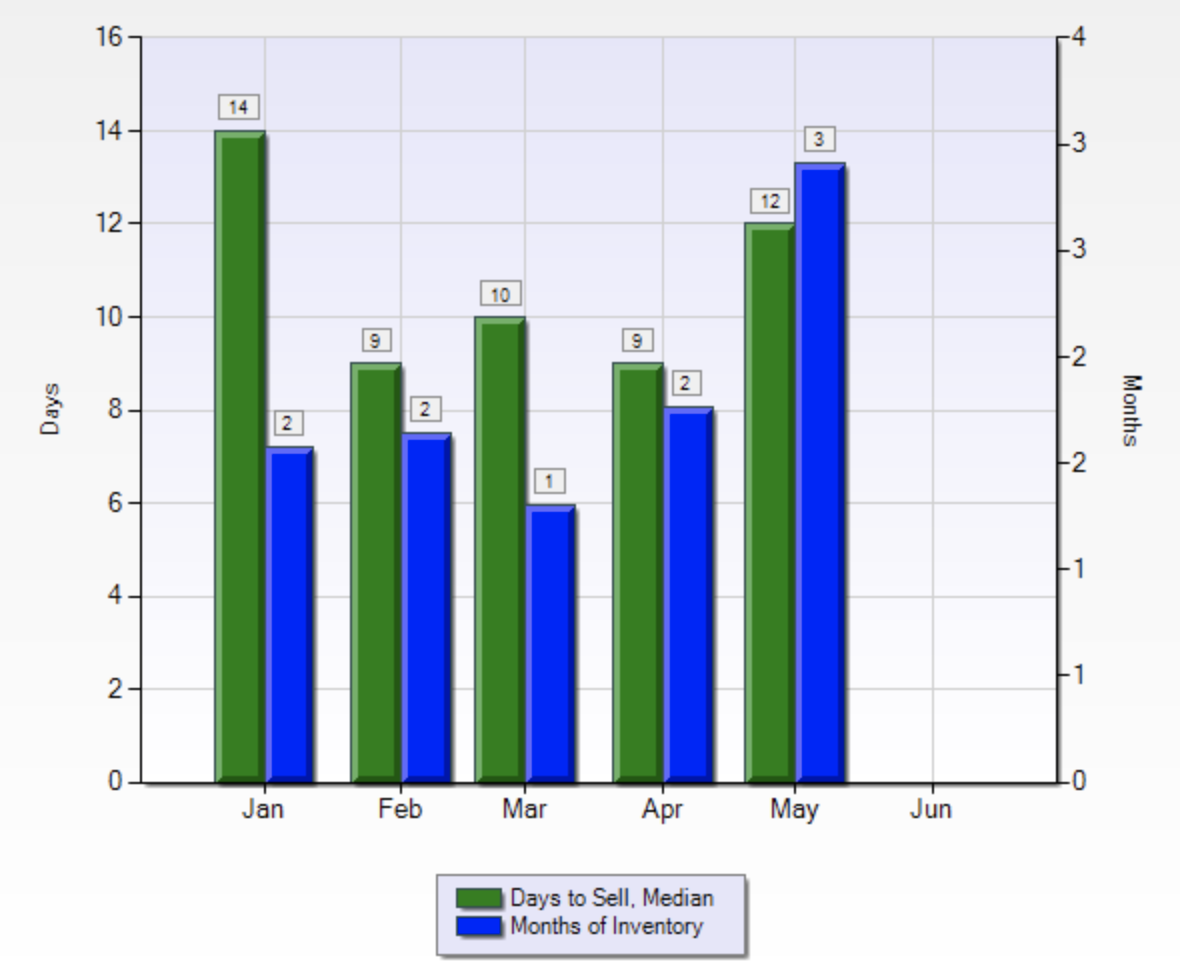

To answer this question we have to take a look at the statistic called month of inventory. Month of inventory(MOI) is the amount of time it would take for everything listed on the market to sell if nothing new was listed. It is calculated by dividing sales by active listings. Less then 3 months of inventory is a sellers market, 4-5 months is balanced, and 6+ is a buyers market. However month of inventory is best looked at in trends, so which was has it been going for the last 3-4 months? Below you can view an interactive chart of the MOI in GreyBruce and Owen Sound.

Is it a good time to sell?

That question depends on your perspective. If you purchased prior to the end of 2021 your home likely still has equity in it. Sale prices and market conditions are still better now than they have been in times past in Grey Bruce. If you are considering selling I would be happy to speak with you about your homes value and what you should expect.

Thinking of selling? download our seller guide!

Curious what your home is worth? request a home valuation.

If you’d like to discuss the market, we’d be happy to chat. I can be reached at tim.matthews@c21.ca or 519.375.7153

Did the market just balance?

Did the market just balance?

Is the Grey Bruce market crashing? There is lots of news going on right now about how sales and prices are dropping fast, but what’s actually happening on the ground in Grey Bruce? Read on and I’ll explain.

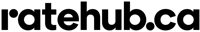

List to sale prices settling down

One of the most interesting stats is the sales to list price. This measures what the sale price is, versus the list price and is a good indicator how far over asking things sell, and the strength of the market, you can see how it peaked in February and has come down since then. Going from 105% in February to 100.6% in May.

More inventory coming quick

More inventory coming quick

The story seems to be more inventory coming on the market, there are currently 600 active listings in Grey Bruce, this is the highest it’s been since 2020. With the surge in active listings, our month of inventory has also gone up. Month of inventory is one of the best stats to see where the market is going and for the first time since 2020 it is above 3, signaling a quick shift from a strong sellers market to a balanced market. The amount of time to sell a house jumped from 9 days to 12 days.

How about prices?

The average price of a residential home in Grey Bruce was $689,000, down slightly from April. However in Owen Sound the average sale price was up from $547k,000 to $584,000.

In summary, sale prices are holding but we are seeing a drastic and quick change in the volume of properties coming on the market. From an on the ground perspective I am seeing less showings on my listings and the majority of properties are not holding offers any more.

What does this mean for buyers and sellers?

If you are a buyer you’ve finally got more options and can probably buy with conditions, and less competition, however if you need a mortgage your purchase power may go down. For sellers, if you need to buy it would be unwise to buy without selling first. It’s not as sure of a deal how fast, and for how much your home will sell for. Sellers also need to understand that the house that sold 2 months ago is no longer a comparable property and the market has changed. Sellers need to price their homes competitively with the other active listings and present them well. The market may look drastically different in 2-3 months.

Thinking of selling? Want to talk about the process? Let’s connect. 519.375.7153 or tim.matthews@c21.ca

Is the real estate market going doing in Owen Sound & Grey Bruce?

Is the real estate market going doing in Owen Sound & Grey Bruce?

We’ve all been inundated with news stories about interest rates, inflation and prices falling but what’s really happening on the ground right here in Grey Bruce?

Let’s start with prices:

The median price in Grey Bruce was $700,000 up 18.5% from last April, and down slightly from March. In Owen Sound it was $567500, down from $603,000 in April.

How about supply & demand?

Perhaps what is most interesting is inventory. There continues to be a good amount of supply coming on the market and with rising rates/cost of inflation cooling buyer demand a bit, we have finally started to see the market shift slightly.

Active Listings in April were 390, this is up sharply from the 272 in March. We had 399 new listings come to market In April up from 315 in March, this has caused our month of inventory to jump from 1.2 up to 1.6.

On average it still took just 10 days for a home to sell and places went for 105.3% of their sale prices.

What does this mean for buyers and sellers?

Well as we know when more inventory comes on the market that gives buyers more options, this means sellers are going to have to be realistic with their price expectations. That house on the street that sold for 800k 2 months ago is no longer a reasonable comp to use.

For the full break down of RAGBOS STATS go here.

Grey Bruce Home Prices in 2021 (Top 3 cheapest places to live in Grey Bruce).

Grey Bruce Home Prices in 2021 (Top 3 cheapest places to live in Grey Bruce).

In Grey Bruce The median sale price finished the year at 598k, up 36 % from last year. How about the municipalities? here are the three cheapest, and most expensive places in 2021.

Top 3 cheapest places:

1. Arran Elderslie (Tara, Allenford, Chesley, Paisley)

Median Sale Price: 443k up 28.4% since 2020

2. Owen Sound: Median Sale price: $480,000 up 37.4% since 2020

3. Hanover Median Sale price: $485, 500 up 27.8% since 2020

Top 3 Most Expensive Places:

1. Grey Highlands: Median Sale Price: $770,000 up 37.5% since 2020

2. Meaford: Median Sale Price: 750k up 25% 1 year, 84.7% 2 years.

3. Georgian Bluffs: Median Sale Price: 749k up 46.9% since 2020

Request a Home Equity Report on your home 👇 https://timmatthews.ca/home-valuation

Grey Bruce Owen Sound Cheapest & Most expensive places to buy in 2021 *Stats are based off of single family homes, Source: https://www.ragbos.com/wp-content/upl…

What to do before selling? 3 things to do to maximize sale price

What to do before selling? 3 things to do to maximize your sale price!

My name is Tim Matthews and I am a Real Estate Agent in the Owen Sound & Grey Bruce area.

What to do before selling?

If you are planning to sell in the next year, here are three things I think you need to do, to make sure you maximize your sale price.

- Declutter – you’re moving, so start packing. Start donating things, making dump runs, and downsizing. Remove things off the fridge, the end tables and countertops. You want to get the house looking as spacious as possible. Don’t forget to do this to your outside yard and basement.

- Clean – Clean everything; walls, windows, counters, faucets, sinks. A clean home shows a real pride of ownership and gives buyers confidence that it was taking care of.

- Repairs – A lot of people want to get overwhelmed with fancy renovations, but you need to start with the big repairs first. I have found that old roofs and furnaces are the biggest hold backs on sales. If your roof needs to be replaced you should absolutely do it.

Now, after you are done this, you can take it up a notch. Here are 3 bonus tips to help get you even more money!

- Paint – you want to think bright, light and neutral. If you want suggestions on paint colours check out this HGTV blog. A fresh coat of light paint can make the home feel new, spacious and clean. Painting kitchen cabinets and exterior doors can be cheap alternatives to full upgrades.

- Electrical updates – If you have dated electrical fixtures, beige switches and plates, you should consider having an electrician come in to swap them out for something more modern. Need an electrician in the Owen Sound area? check out Benedict Electric.

- Door handles and kitchen cabinet knobs. If your knobs are the shiny brass ones or white, it’s time for an upgrade. Swap these out to make your home feel more updated.

Doing all of these suggestions will put you well on your way for a great sale price. If you are reading this are in the Owen Sound/ Grey County area, it would be a great idea to have me out to look at your home and come up with a sale plan. Connect with me here or call me at 519.375.7153.

November Grey Bruce Market Update

The Real Estate Market in Grey Bruce Owen Sound stayed strong in November & I’m giving the market 9/10🔥for how hot it was. Watch this video below and I’ll explain why.

Do I have to pay capital gains tax if I sell my house before living there one year?

Do I have to pay capital gains tax if I sell my house before living there one year?

If you’ve sold Real Estate recently you’ll need to make sure you report it on your upcoming taxes. If the property you sold was your principal residence, you won’t have to pay capital gains tax on it as you will be exempt based on the Principal residence exemption (PRE). What defines principal residence? You can have one principal residence a year that you must have generally lived in over the year. Many people think you have to live in your principal residence for a full year to avoid paying capital gains tax, this is not true and there is no set time frame for which you must occupy the residence. It’s called the ordinary inhabited rule.

Now, if you’ve been buying properties and flipping them every year all while claiming the principal residence exemption, you might have something to be concerned about. An article by the Financial Post talks about how a couple bought and sold real estate in 5 consecutive years. In each case they made improvements to the home and sold them for a significant profit. They were found guilty of not properly using the PRE. You can read about it here.

For someone who has decided to sell for personal reasons, employment change, or simply wanted to rent, you don’t need to worry about this. However, if you frequently buy and sell real estate while claiming the PRE, it’s possible that the CRA could question your motives.

Need to connect with an accountant? Contact Adam here.

Want to talk Real Estate? Let’s Connect!

*This is for educational purposes only and should not be taking as tax or financial advise, talk to an accountant.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

More inventory coming quick

More inventory coming quick